BTC Price Prediction: Navigating Volatility with Strategic Accumulation

#BTC

- Technical Positioning: BTC trades near moving average with bearish MACD momentum suggesting consolidation phase

- Market Sentiment: Mixed signals between institutional adoption and whale profit-taking creating volatility

- Investment Outlook: Long-term accumulation potential exists but requires risk management amid current uncertainty

BTC Price Prediction

Technical Analysis: BTC Shows Mixed Signals Near Key Levels

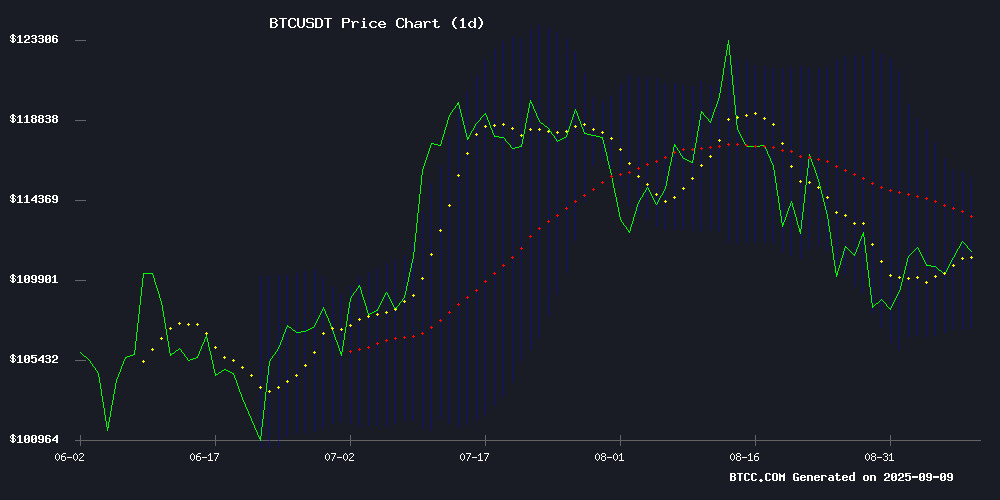

BTC is currently trading at $112,640, slightly above its 20-day moving average of $111,455.81, indicating near-term stability. The MACD reading of -972.49 suggests bearish momentum persists, though the price remains within Bollinger Bands with support at $107,196 and resistance at $115,715. According to BTCC financial analyst Emma, 'The convergence around the moving average points to consolidation, but a break below the lower Bollinger Band could signal further downside risk.'

Market Sentiment: Negative Headlines Offset by Institutional Support

Recent news presents a mixed picture for Bitcoin. While whale selling and mining difficulty increases create headwinds, institutional adoption continues with El Salvador's ongoing accumulation and record trading volumes on Binance. BTCC financial analyst Emma notes, 'The market is balancing between short-term profit-taking and long-term institutional confidence. Tether's commitment to Bitcoin and national-level accumulation provide underlying support despite volatility concerns.'

Factors Influencing BTC's Price

NYDIG Warns of Volatility Risks for Bitcoin Treasury Firms as Premiums Shrink

Bitcoin treasury firms face mounting volatility risks as the premium between their stock prices and underlying Bitcoin holdings narrows, according to NYDIG analysts. Despite BTC trading near record highs, firms like MicroStrategy and Metaplanet have seen their share price premiums compress amid investor concerns.

Greg Cipolaro, NYDIG's global head of research, identifies multiple pressure points: looming supply unlocks, shifting corporate strategies, increased share dilution, and undifferentiated treasury management approaches. "Investor anxiety is manifesting in profit-taking and reduced risk appetite," he noted.

The analysis warns of potential cascading sell pressure as companies await mergers or public listings. Cipolaro suggests share buybacks as a critical defense mechanism if stocks fall below net asset value, advising firms to "preserve dry powder from previous fundraising rounds."

El Salvador Expands Bitcoin Reserves on National Bitcoin Day

El Salvador purchased an additional 21 BTC during its national bitcoin Day celebration, bringing its total holdings to 6,313.18 BTC—valued at approximately $702 million. President Nayib Bukele framed the acquisition as symbolic of Bitcoin's 21 million supply cap, reinforcing the country's reserve-building strategy. The move coincides with the fourth anniversary of El Salvador's groundbreaking decision to adopt Bitcoin as legal tender alongside the U.S. dollar.

On-chain data reveals a steady accumulation pattern, with the nation adding ~28 BTC over the past week and 50 BTC in the last month. Since March 2024, El Salvador has maintained a pace of roughly 1 BTC purchased daily. This persistent accumulation occurs despite IMF objections to the voluntary BTC acquisition program.

Critics like Blockchain.com's Nicolas Cary argue the top-down implementation contradicts crypto's grassroots ethos. Yet Bukele's administration continues advancing its Bitcoin agenda, with the Bitcoin Office reporting consistent reserve growth. The purchases underscore El Salvador's unique position as the first sovereign adopter of Bitcoin as legal tender—a policy that continues to shape global conversations about state-level crypto integration.

Binance Futures Trading Volume Hits Record $2.62 Trillion in August 2025

Binance's futures platform achieved a historic milestone in August 2025, with trading volume surging to $2.626 trillion—the highest monthly figure recorded this year. The figure eclipsed July's $2.552 trillion as both retail and institutional traders flooded back into the market.

Analysts attribute the surge to extreme volatility in Bitcoin, which saw sharp rallies followed by rapid pullbacks, creating ideal conditions for Leveraged trading. Open interest rose in tandem with volume, signaling fresh capital deployment rather than mere liquidations.

Institutional players, including hedge funds, have re-entered the fray, taking both long and short positions amid stabilized ETF flows and renewed confidence in crypto derivatives. The data underscores Binance's dominance as the preferred venue for sophisticated traders navigating turbulent markets.

Tether CEO Paolo Ardoino Denies Bitcoin Sale Rumors

Tether CEO Paolo Ardoino has publicly refuted claims that the company sold Bitcoin. In a statement on social media platform X, Ardoino emphasized that Tether maintains its holdings, dispelling market speculation.

The clarification comes amid heightened scrutiny of stablecoin issuers' reserve management. Tether's transparency stance contrasts with broader industry debates about cryptocurrency backing and liquidity.

Bitcoin Whales Trigger Largest Sell-Off Since 2022

Bitcoin whales have offloaded approximately 115,000 BTC—worth $12.7 billion—over the past month, marking the most significant distribution by major holders since July 2022. The sell-off contributed to downward pressure on Bitcoin's price, which briefly dipped below $108,000.

CryptoQuant analyst 'caueconomy' notes whale reserves declined by over 100,000 BTC in thirty days, with a seven-day balance change hitting a March 2021 high. Nearly 95,000 BTC moved in a single week, though selling momentum eased to 38,000 BTC by September 6.

Institutional demand emerges as a counterforce. LVRG Research's Nick Ruck highlights ETF inflows and accumulation as structural support, suggesting traders monitor the tug-of-war between whale exits and institutional dip-buying. Macroeconomic catalysts, particularly the Fed's September rate decision, loom as potential market pivots.

Bitcoin Price Weakens Amid Consolidation, Risk of Further Decline Looms

Bitcoin's recovery attempt stalls below $111,500 as bears maintain pressure. The cryptocurrency faces potential downside if bulls fail to defend the $110,000 support level. Current price action shows consolidation NEAR $110,500, with immediate resistance at $111,250.

A bullish trend line forms on hourly charts, offering temporary support. However, failure to reclaim the 100-hour moving average suggests lingering weakness. Market participants watch the 50% Fibonacci retracement level at $111,700 as a key hurdle for any meaningful recovery.

Bitcoin Recovery Stalls Amid Strong Resistance

Bitcoin's attempt to recover from recent losses has faltered, with the cryptocurrency failing to break through a critical resistance level near $114,000-$116,000. The rejection below the 50-day moving average signals persistent selling pressure, leaving the market vulnerable to further declines.

The asset now trades near $111,121, with the 100-day EMA at $110,785 acting as the next key support. A breach could open the door to a test of $104,520—a level not seen since May—confirming a broader corrective phase.

Momentum indicators reflect weakening demand. The RSI lingers at 46, while dwindling trading volumes suggest fading enthusiasm. Without renewed buying interest, Bitcoin appears more likely to drift lower than stage another sharp rally.

El Salvador Commemorates Bitcoin Day with Symbolic 21 BTC Purchase Amid Market Uncertainty

El Salvador's President Nayib Bukele marked Bitcoin Day with the purchase of 21 BTC, valued at approximately $2.33 million, reinforcing the country's pioneering stance on cryptocurrency adoption. The gesture celebrates September 7, 2021, when El Salvador became the first nation to recognize Bitcoin as legal tender.

The anniversary arrives during a period of heightened market tension. While El Salvador integrates Bitcoin into its reserves strategy alongside gold, skepticism persists. The IMF has raised concerns over transparency, and analysts highlight historical seasonal weaknesses. Timothy Peterson, author of Metcalfe’s Law as a Model for Bitcoin’s Value, points to September 8 as historically one of Bitcoin’s worst-performing days, with a 72% likelihood of losses.

Despite short-term volatility, long-term Optimism remains. Whale activity suggests $10 billion in Bitcoin shorts could face liquidation if prices reach $117,000. Scarcity continues to underpin bullish sentiment, with only about two million BTC actively circulating. MicroStrategy co-founder Michael Saylor, whose firm holds over 636,000 BTC, exemplifies institutional conviction in Bitcoin’s future.

Tether CEO Denies Bitcoin-to-Gold Swap Speculation, Reaffirms BTC Commitment

Tether CEO Paolo Ardoino has dismissed rumors that the stablecoin issuer is selling Bitcoin to bolster its Gold reserves. The speculation arose after analyst Clive Thompson cited BDO attestations showing a decline in Tether's BTC holdings from 92,650 to 83,274 between Q1 and Q2 2025.

Jan3 CEO Samson Mow clarified the discrepancy, revealing Tether had transferred nearly 20,000 BTC to its investment vehicle XXI—a MOVE not reflected in Thompson's analysis. This adjustment means Tether's net Bitcoin holdings actually grew by over 10,000 BTC mid-year. "Tether continues to allocate profits into safe assets like Bitcoin, gold, and land," Ardoino stated, emphasizing no BTC was sold.

The company maintains $8.7 billion in gold reserves—approximately 80 tons stored in Zurich—while its gold-backed token XAUt recently surpassed $1.3 billion market capitalization. The diversification strategy balances Bitcoin accumulation with hard asset exposure amid global economic uncertainty. Ardoino condemned the gold-for-Bitcoin narrative as fear-mongering misinformation.

Bitcoin Mining Difficulty Reaches Historic High, Pressuring Miner Margins

Bitcoin's mining difficulty has surged to an unprecedented 136 trillion, intensifying the strain on miners grappling with declining revenues. The 4% increase from 129.6 trillion, recorded at block height 913,248, marks the fifth consecutive rise since June. This adjustment mechanism, recalibrated every 2,016 blocks, ensures block production remains near the 10-minute target—a higher difficulty signals growing network competition, while a drop reflects miner attrition.

The record comes amid deteriorating mining economics. Bitcoin's hashprice—revenue per unit of computing power—has plummeted to $51, its lowest since June. August's average hashprice of $56.44 reflects a 5% monthly decline, highlighting escalating margin pressures. Transaction fees offer no respite, with miners earning just 0.025 BTC per block in August, a 20% drop from July and the weakest performance since 2011. Dollar-denominated daily fee revenue averaged $2,904, the lowest since 2013.

With soaring difficulty and shrinking income streams, miners face a precarious balancing act. A significant Bitcoin price rally or a surge in on-chain activity to boost fees may be the only lifelines left.

Bitcoin Whales Unload 112K BTC in a Month, Signaling Potential Bearish Turn

Bitcoin's whale reserve has recorded its most significant drop since 2022, with large holders offloading over 112,000 BTC in just one month. This marks the steepest net distribution in two years, raising questions about whether this is a strategic rotation or a precursor to deeper price declines.

The 1k–10k BTC cohort, which had accumulated roughly 270k BTC between April and August, began rapidly divesting as Bitcoin touched its $124k local all-time high. The 30-day change in whale holdings now stands at -112.8k BTC, according to CryptoQuant data—a clear signal of profit-taking after Bitcoin's 50% rally post-Liberation Day FUD.

August saw Bitcoin close 6.5% lower, breaking a four-month green streak and failing to hold key support levels. With monthly closes consistently below $110k since July, technical indicators suggest fragility in Bitcoin's current price structure.

Is BTC a good investment?

Based on current technical and fundamental analysis, BTC presents both opportunities and risks for investors. The current price of $112,640 sits above key support levels, but negative MACD momentum and whale selling activity suggest near-term caution may be warranted.

| Metric | Value | Interpretation |

|---|---|---|

| Current Price | $112,640 | Above 20-day MA support |

| MACD | -972.49 | Bearish momentum |

| Bollinger Position | Middle band | Neutral territory |

| Whale Activity | 112K BTC sold | Significant selling pressure |

Emma from BTCC suggests: 'For long-term investors, current levels may offer accumulation opportunities, but short-term traders should wait for clearer directional signals above $115,715 or below $107,196.'